Trending →

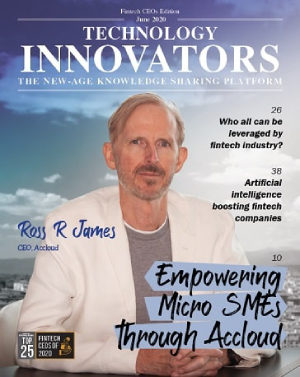

Technological advances, changing demand for financial products and competition in financial services are all driving a new wave of fintech startups and investments that have drawn attention to the industry in recent years. This is mainly because of the fact that financial technology has the potential to revolutionize and bring in massive changes in the lifestyles of people as well as in the ways that they conduct business. Today, there is a lively competitive environment for innovation because of the diversity of ideas regarding the contributions the technology could make to businesses. Evidently, advances in artificial intelligence and data handling and analytics are driving more innovation in the sector. However, new innovations come with challenges such as regulatory framework, political uncertainty, data security and tax implications. Taking steps to alleviate these issues, the industry aims to make institutions more efficient and effective, provide consumers and businesses with more choices, increase transparency and cut down on the amount of time wasted during financial transactions. This calls for advanced expertise, creativity and knowledge transfer to revolutionize the fintech field. Keeping this in mind, we are bringing to you the Top 25 Fintech CEOs of 2020 in this issue. The key objective is to help you gain insight on transformation of fintech and enhance the quality of your products and services. The issue gives a myriad of experiential learning from C-level executives and experts in the fintech industry.