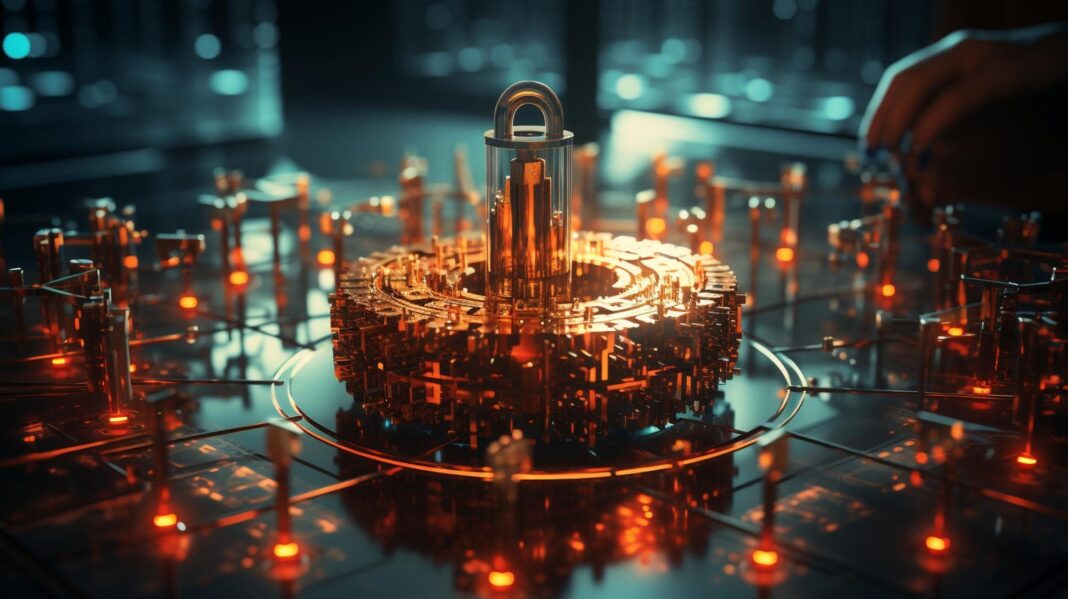

Quantum computing has emerged as a disruptive technology with the potential to revolutionize various industries, including the Banking, Financial Services, and Insurance (BFSI) sector. Its unparalleled computational power and ability to solve complex problems make it particularly promising for applications in financial modeling and analysis. This article delves into the potential applications of quantum computing in the BFSI sector, exploring its implications for financial modeling, risk analysis, portfolio optimization, and more.

- Understanding Quantum Computing:

- Quantum Bits (Qubits): Unlike classical computers that use bits as binary units (0 or 1), quantum computers utilize qubits, which can exist in multiple states simultaneously due to principles of quantum mechanics, such as superposition and entanglement.

- Quantum Parallelism: Quantum computers leverage quantum parallelism to perform computations on a massive scale simultaneously, enabling them to solve complex problems exponentially faster than classical computers.

- Quantum Supremacy: Quantum supremacy refers to the milestone at which a quantum computer can outperform the most powerful classical supercomputers in solving specific tasks, demonstrating the potential of quantum computing.

- Potential Applications in Financial Modeling and Analysis:

- Portfolio Optimization: Quantum computing can optimize investment portfolios by efficiently analyzing vast amounts of historical and real-time market data, considering multiple variables and constraints to maximize returns while minimizing risk.

- Risk Analysis: Quantum computing can enhance risk analysis in the BFSI sector by accurately assessing and modeling various risk factors, such as market volatility, credit risk, liquidity risk, and operational risk, enabling more informed decision-making and risk management strategies.

- Option Pricing and Valuation: Quantum algorithms can improve option pricing and valuation models by simulating complex financial derivatives and pricing mechanisms more accurately, accounting for non-linearities and stochastic processes with greater precision.

- Fraud Detection: Quantum computing can enhance fraud detection capabilities by analyzing large datasets of financial transactions, identifying patterns, anomalies, and suspicious activities in real-time, and predicting fraudulent behavior more effectively.

- Algorithmic Trading: Quantum algorithms can optimize algorithmic trading strategies by analyzing market data, identifying arbitrage opportunities, and executing trades at lightning speed, leveraging quantum parallelism and optimization techniques to gain a competitive edge in financial markets.

- Challenges and Considerations:

- Hardware Limitations: Quantum computing is still in its nascent stages, and practical quantum computers with sufficient qubits and coherence times for complex financial applications are not yet widely available.

- Quantum Error Correction: Quantum computers are susceptible to errors due to decoherence and noise, requiring robust error correction techniques to maintain the integrity of computations and ensure reliable results.

- Quantum Software Development: Quantum programming languages and algorithms for financial applications are still evolving, requiring specialized expertise and skills in quantum mechanics, mathematics, and computer science.

- Integration with Existing Systems: Integrating quantum computing technologies with existing IT infrastructure and software systems in the BFSI sector poses challenges in terms of compatibility, scalability, and security.

- Future Outlook and Implications:

- Quantum Advantage: As quantum computing technology matures, it is expected to offer a quantum advantage over classical computing for specific financial applications, unlocking new possibilities for innovation and optimization in the BFSI sector.

- Industry Collaboration: Financial institutions, fintech startups, and quantum computing companies are collaborating to explore and develop quantum-enabled solutions for financial modeling, risk analysis, trading, and other applications.

- Regulatory Considerations: Regulatory authorities are monitoring developments in quantum computing and considering implications for financial markets, risk management, and data privacy, ensuring appropriate oversight and compliance in the BFSI sector.

Conclusion: Quantum computing holds immense potential to transform financial modeling and analysis in the BFSI sector, offering unprecedented computational power and capabilities to address complex challenges and unlock new opportunities for innovation and optimization. While practical implementation and adoption of quantum-enabled solutions may still be years away, ongoing research, collaboration, and advancements in quantum computing technology are paving the way for a quantum-powered future in finance.