In the fast-evolving world of financial technology, contactless payments have become the new normal. From grocery stores to public transport, consumers today prefer quick, secure, and touch-free payment options. As we move deeper into 2025, this technology is no longer just a convenience — it represents the future of financial transactions, reshaping the way people and businesses exchange money.

The Evolution of Contactless Payments

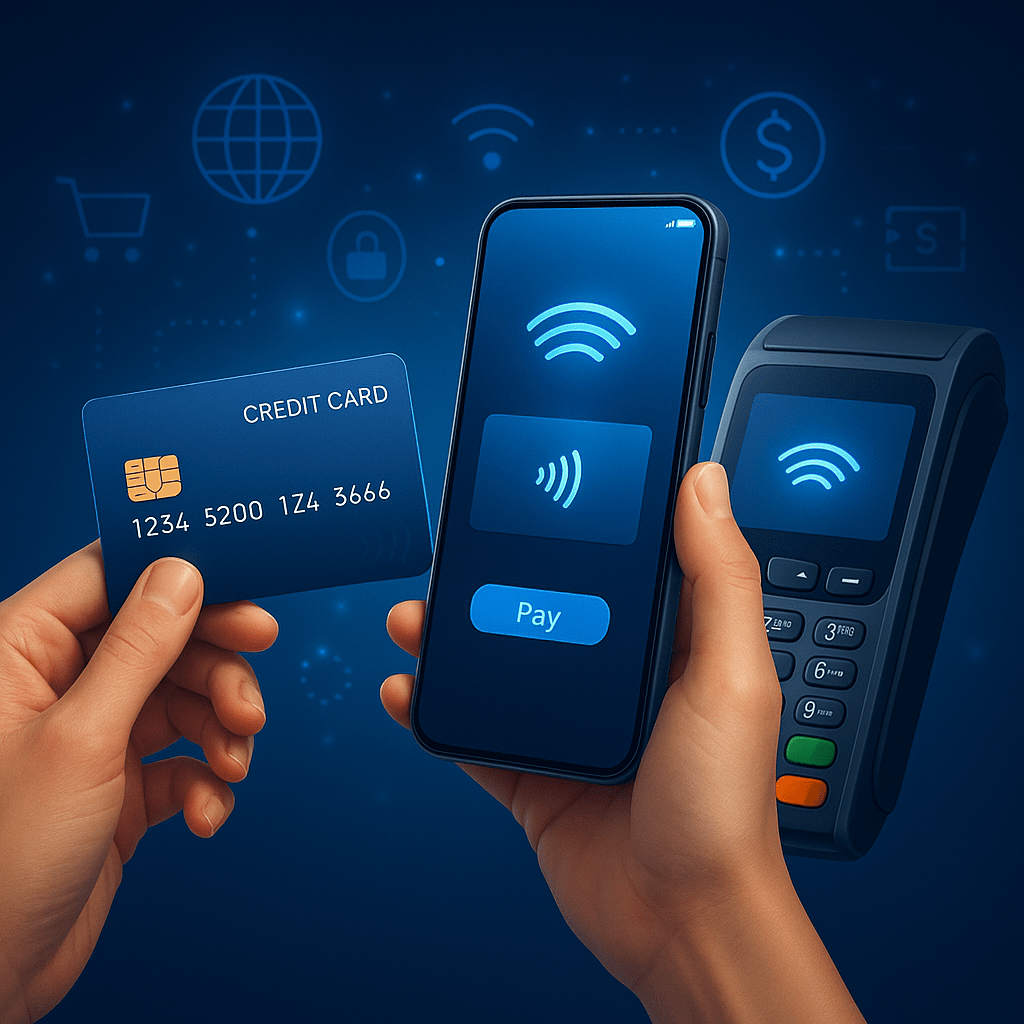

The idea of contactless payment emerged in the early 2000s, but it truly gained traction during the 2010s with the rise of Near Field Communication (NFC) technology. Over time, payment cards, smartphones, and wearables began integrating NFC chips that allowed users to make instant payments by simply tapping their device at a point-of-sale (POS) terminal.

The COVID-19 pandemic accelerated adoption worldwide. Consumers and businesses sought touch-free methods to reduce physical interaction, and contactless payments became the safest and most efficient option. According to global reports, over 80% of consumers now prefer contactless payment options for in-store purchases.

How Contactless Payments Work

Contactless payments use NFC (Near Field Communication) or RFID (Radio Frequency Identification) technology to transmit payment information securely between a card or mobile device and a payment terminal.

When a user taps a credit card, smartwatch, or smartphone on the payment terminal, the chip generates a unique encrypted code for that transaction — ensuring that personal and card details are never exposed. This makes contactless transactions fast, secure, and nearly impossible to duplicate.

Popular forms include:

-

Contactless credit/debit cards

-

Mobile wallets (Apple Pay, Google Pay, Samsung Pay)

-

Wearable payments (smartwatches, fitness bands)

-

QR code-based contactless systems

Why Contactless Payments Are the Future

1. Speed and Convenience

Transactions that once took 30–40 seconds now complete in less than two seconds. In retail and transit systems, this has improved efficiency and reduced queues dramatically. The frictionless experience enhances customer satisfaction and encourages repeat business.

2. Enhanced Security

Contactless payments employ tokenization, replacing sensitive card data with a one-time code. Even if intercepted, the token is useless to hackers. Combined with biometric authentication (like Face ID or fingerprint recognition), contactless payments offer a high level of transaction security.

3. Health and Hygiene

The pandemic made hygiene a priority. Contactless transactions eliminate the need to touch terminals, exchange cash, or handle receipts — a key reason why adoption skyrocketed globally between 2020 and 2024.

4. Integration with Smart Devices

Wearable devices such as smartwatches and fitness bands are becoming payment tools. For example, Apple Watch and Garmin Pay users can make payments during workouts, travel, or shopping — without needing their phones or wallets.

5. Growth of Digital Wallet Ecosystems

Digital wallets are now central to financial ecosystems, integrating payments, rewards, investments, and identity verification. These all-in-one apps are pushing traditional banks to innovate faster and rethink customer engagement.

Global Adoption and Market Trends

The global contactless payment market is projected to surpass $20 trillion in transactions by 2030, according to Statista and McKinsey reports. Key markets leading the shift include Europe, the UAE, Singapore, and the United States.

In regions like the UAE and India, fintech companies are partnering with banks to deliver instant payment solutions compatible with both NFC and QR technology. Government initiatives promoting cashless economies have accelerated the growth further.

Additionally, transit systems in major cities like London, Dubai, and Singapore now accept contactless cards directly — reducing ticketing infrastructure and improving passenger flow.

Security and Regulatory Landscape

As digital payment adoption grows, so do concerns about data privacy and fraud. Regulators are responding with enhanced frameworks to ensure consumer protection.

Key measures include:

-

EMV (Europay, Mastercard, Visa) chip standards for all contactless cards.

-

Strong Customer Authentication (SCA) rules in regions like the EU.

-

Two-factor authentication and token-based encryption for mobile payments.

Financial institutions also employ AI-powered fraud detection tools that monitor behavioral patterns and detect anomalies in real time — ensuring that contactless transactions remain safe and trustworthy.

The Role of Fintech Innovation

Fintech startups are the driving force behind this revolution. They are:

-

Introducing instant peer-to-peer contactless transfers.

-

Developing biometric payment cards with built-in fingerprint sensors.

-

Expanding cross-border payment compatibility to reduce foreign transaction costs.

-

Integrating blockchain technology to increase transparency and speed in settlements.

By leveraging these innovations, fintechs are helping traditional banks stay competitive in a digital-first economy.

Challenges Ahead

Despite the rapid growth, a few challenges remain:

-

Infrastructure gaps in developing markets slow down adoption.

-

Transaction limits on contactless payments still exist in some regions.

-

Consumer awareness around digital safety needs continued emphasis.

However, as fintech players collaborate with regulators and payment networks, these challenges are being gradually resolved.

What’s Next?

Looking forward, biometric payments, voice authentication, and AI-driven personalization will define the next phase of contactless evolution. Smart devices may soon recognize users automatically, authorizing payments securely through voice, face, or even motion gestures.

As digital banking ecosystems expand, contactless payments will evolve into “invisible transactions” — seamless, secure, and instant — shaping a new era of finance where technology and trust go hand in hand.

Conclusion

Contactless payments have moved from a luxury to a lifestyle necessity. As fintech innovations continue to evolve, the future of transactions lies in speed, safety, and seamless user experience.

Whether it’s a smartwatch tap or a phone wave, the message is clear — cashless is the new normal, and contactless is the future of banking.