Artificial intelligence is boosting hedging of financial market risks

n a highly complex and dynamic world, economic changes are constantly increasing. Developments and trends are becoming more and more difficult to assess. Many companies and institutions are therefore already using artificial intelligence (AI) to anticipate and to forecast important changes. AI-based technology hedge21® can predict financial market risks and commodity price developments, identify optimal hedging strategies, and provide decision support.

Hedging currency and commodity price risks with artificial intelligence

The complexity and the speed of changes in economic drivers and international trends have an impact on businesses. It is becoming increasingly difficult for companies, CFOs, or treasurers to analyze the available data in the short term and make efficient decisions. Deep Technology based on artificial intelligence is nowadays able to analyze and draw conclusions from large amounts of data. Changes in macroeconomic influencing factors can be considered in real time and incorporated into decisions. Artificial intelligence is thus able to illustrate a real picture of actual developments and trends.

But the focus is also on the company itself. This is because they try to offer the best products through international procurement and many suppliers. As a result, this also leads to an increase in complexity within the company. But what are the advantages of having a good information base and knowing your own company’s goals and constraints? It is much more crucial to combine this information wisely and draw conclusions from it. Artificial intelligence offers the possibility to derive and give recommendations for action from the combination of information. AI-based algorithms can determine the advantageousness of choices. In this way, decision support can be proposed and offered even under uncertainty.

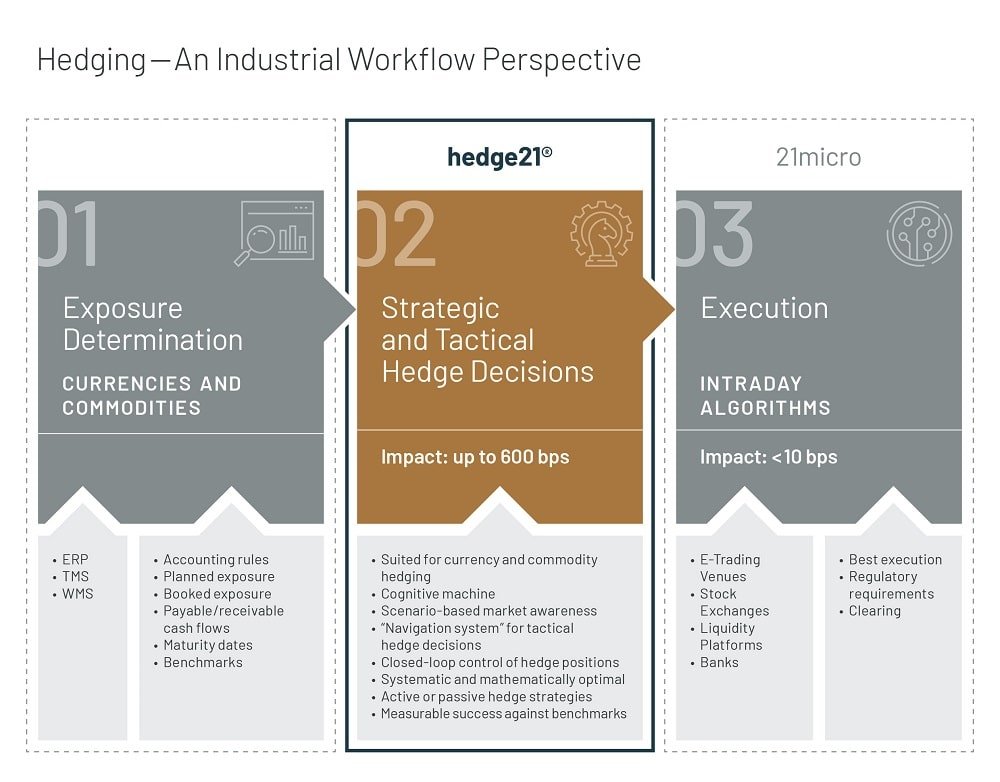

Hedge21® is an AI-based technology that optimizes the hedging of financial market risks. For risks such as currency risk, interest rate risk, and commodity price risk, the AI-based technology can determine an optimal hedging strategy and provide decision support.

The technology is based on real-time data. It does so by combining current economic information and developments with company-specific conditions. This enables targeted decision support for hedging based on macroeconomic conditions and the company’s specific requirements. Hedge21® determines optimized decisions under uncertainty. It enables a daily optimal hedging strategy considering the company’s hedging policy and its constraints.

Hedge21® can be used for various cases for financial market risks. Key applications are changes in exchange rates and commodity price risks in international trade. Hedge21® analyzes changes in certain parameters that have an impact on the exchange rate and thus on hedging. The current interest rate policies of central banks, inflation rates and GDP growth rates are considered when determining an optimal hedging strategy.

In addition, companies today are also confronted with a multitude of different and specific customer requirements. This makes purchasing increasingly complex and places high performance requirements on products in terms of quality, prices, or delivery times. As a result, many companies are forced to increasingly align and diversify their purchasing internationally. Changes in raw material prices can play a significant role here. Geopolitical measures, such as tariffs and sanctions or price changes of related products are included in the determination of optimal hedging strategies.

Hedge21® as an AI-based technology therefore offers a high degree of flexibility. The transfer to further general and specific use cases is possible. Contact us to find out how we can support you. www.21strategies.com