The auto industry is undergoing a once-in-a-century transformation — not driven by engines or batteries, but by software. The modern car is no longer a mechanical machine; it’s a rolling computer, powered by an operating system that manages everything from infotainment to autonomous driving.

This has sparked the Automotive OS Wars — a battle between automakers, tech giants, chip companies, and software ecosystems to control the most valuable layer of the car: the software brain.

Who wins the Automotive OS war will control the future of mobility, data, revenue, and customer ownership.

1. What Is an Automotive Operating System (Auto-OS)?

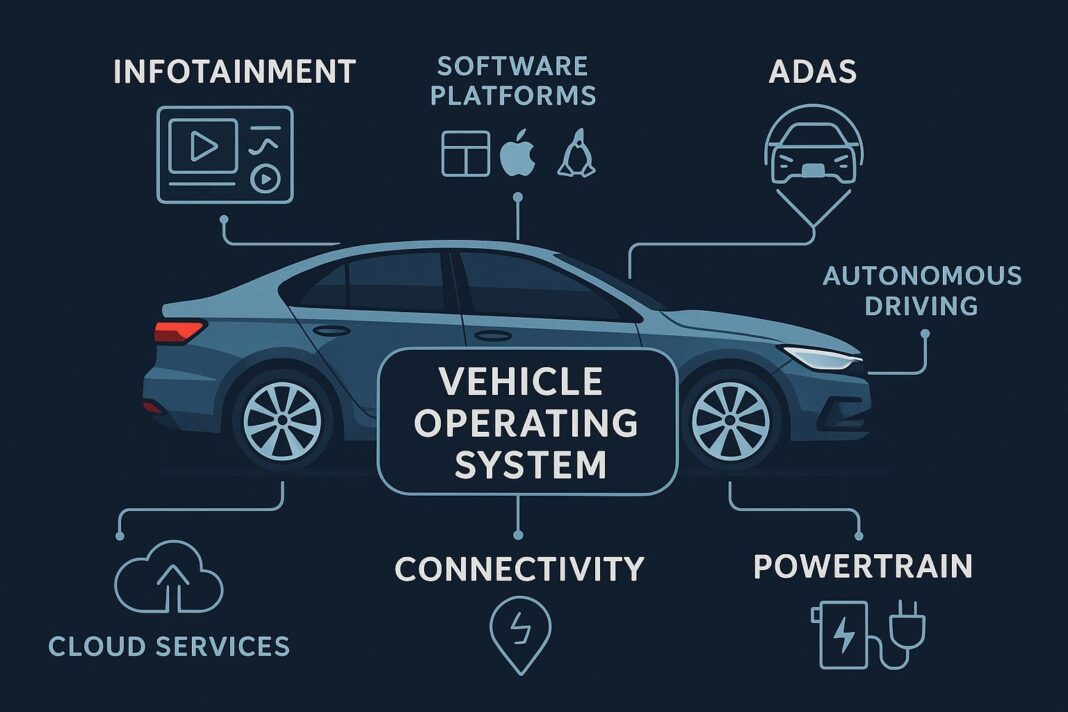

An Automotive OS is the core software layer that governs:

-

Infotainment

-

Advanced driver assistance (ADAS)

-

Navigation

-

Connectivity

-

Battery management (for EVs)

-

Safety systems

-

Over-the-air (OTA) updates

-

Autonomous features

It’s the “Android/iOS” equivalent for vehicles — and the company that owns it controls the entire in-car digital experience.

2. Why the OS Is the New Battleground

A. Software = Recurring Revenue

Carmakers can sell:

-

Navigation subscriptions

-

Autonomous driving upgrades

-

Smart features

-

Entertainment packages

-

Performance boosts

Software margins are 10× higher than hardware.

B. Data Is the New Oil

Connected cars generate 25 GB/hour of data.

Whoever controls the OS controls:

-

Driver behavior data

-

Battery + vehicle health data

-

Location info

-

Infotainment preferences

This data fuels AI, advertising, personalization, and predictive maintenance.

C. Autonomous Driving Depends on the OS

A single unified OS makes it possible to integrate:

-

Sensors

-

AI models

-

Cloud systems

-

V2X communication

Without a central OS platform, autonomy fails.

3. The Main Players in the Automotive OS War

1. Tesla — The Pioneer

-

Full in-house OS + UI

-

Controls everything from battery to autonomy

-

Fast OTA updates

-

Strong ecosystem lock-in

Strength: Vertical integration

Weakness: Closed ecosystem limits partnerships

2. Google — Android Automotive OS (AAOS)

Used by:

-

Volvo/Polestar

-

GM (earlier models)

-

Renault

-

Honda

Strength: App ecosystem (Maps, Assistant, Play Store)

Weakness: Automakers fear Google owning user data

3. Apple — Next-Gen CarPlay

Apple is turning CarPlay into a full vehicle interface:

-

Controls HVAC, clusters, navigation

-

Uses Apple UI and services

-

Deep brand loyalty

Strength: Seamless iPhone integration

Weakness: OEMs lose control of UX + data

4. Automaker-Owned OS Platforms

Mercedes MB.OS

-

Built on Nvidia DRIVE

-

Real-time 3D graphics

-

AI personalization

-

Level 3 autonomy-ready

BMW iDrive 9

-

Built on Android open-source

-

Custom UI

-

Focus on premium UX

Volkswagen CARIAD (in rebuild mode)

-

Trying to unify all VW brands

-

Software delays slowed rollout

GM Ultifi OS

-

Based on Linux

-

Deep integration with Super Cruise / Ultra Cruise

Strength: Full control

Weakness: Hard to match Silicon Valley speed

5. Chinese Tech Giants

Huawei, Baidu, Alibaba, Tencent

Leading globally in:

-

AI driving

-

In-car voice assistants

-

Connected services

China’s automotive OS market is the most advanced due to internal competition.

4. The Central Computing Revolution

Older cars use 70+ ECUs (small computers).

The future uses 1–3 central supercomputers powered by:

-

Qualcomm Snapdragon Ride

-

Nvidia DRIVE Orin / Thor

-

Intel Mobileye EyeQ

-

Tesla Dojo

This shift makes updates, AI, and sensor fusion possible.

5. Who Will Win? (2025–2035 Outlook)

Short-Term (2025–2027):

-

Android Automotive grows fastest

-

Apple expands CarPlay takeover

-

OEMs improve own OS platforms

Mid-Term (2027–2030):

-

Tesla, Mercedes, and BMW lead premium connected OS

-

Google dominates mid-range cars

-

Chinese OS platforms expand globally

Long-Term (2030–2035):

The market consolidates into 4 major OS ecosystems:

-

Tesla OS

-

Android Automotive OS

-

Apple Car OS

-

OEM Unified Platforms (MB.OS, iDrive, Ultifi, etc.)

Who wins depends on:

-

App ecosystems

-

Partner networks

-

Hardware integration

-

Data ownership

-

Autonomous driving performance

6. What the Automotive OS War Means for Consumers

✔ More personalized cars

✔ Always-improving OTA updates

✔ Better maps, entertainment, and navigation

✔ Smart diagnostics

✔ Software upgrades instead of new car purchases

But also:

❗ Increased data collection

❗ Proprietary ecosystems

❗ Higher subscription dependency

The future car will feel more like a smartphone on wheels — with all the benefits and trade-offs.